Compound Growth

is the secret to wealth

Learn how to build your wealth!

5 ways with likely outcomes

Make Compound Growth work for you

Balance Risk and Opportunity

Understand the Forex Market

Find Your way to Wealth

If you can spare 15 minutes now, watch the video and I can show you how.

5 ways to get rich

1. Invest throughout your life, and retire rich.

There are plenty of examples of people who have made a habit early in life, of

saving a small amount of money and putting it into investments on a monthly

basis. These people take advantage of compound growth, and by the time they retire they have built a portfolio which is worth far more then the monthly contributions they put in throughout their life. However, many

people find it very difficult to save any money at all, let alone to build a habit of doing it throughout their life. In addition, it takes most of these

successful people 30 or 40 years of constant investing to reach a place where they might consider themselves rich. So this is a difficult, if successful, get

rich slow scheme.

2. Start your own business.

I have started several businesses, and I know how hard it is to make them successful. It requires a lot of effort, long hours, a lot of learning, and a fair amount of luck to become really successful. The statistics are depressing. Only a tiny minority of people who start their own business end up wealthy. The majority end up working long hours in a job that they may enjoy, but that leaves them very little time for the rest of their life interests, And they remain just over broke for as long as the business keeps going.

3. Play the stock market.

There are two ways of going about this. One is to buy into a tracker fund that will go up with the gradual increase in value of the stock market. On average over the last few decades the major stock markets have grown at about 8% per year. While that is not much better than inflation, and probably better than the interest you would get on a deposit account at a bank, unless you have a lot of money to start with an 8% gain is not going to make you rich in a hurry. The other way, which has a much bigger potential but also a much greater risk, is to pick individual stocks hoping to buy low and sell high. If you're lucky doing this, you may beat the market and make 20 or 30% profit every year, but if you're not lucky you could lose just as much, or even everything.

4. A side hustle on the Internet.

The Internet has made many millionaires. A lot of those millionaires are very happy telling other people how they too can make vast amounts of money in a very short time, and charging them a healthy fee for the information. Courses on how to get rich are a boom industry at the moment. Sadly, many of the people who follow this advice and try to start their own side hustle, never get it off the ground. They put in weeks or months of effort, typically spend up to £10,000 on advice from gurus to guarantee their success, and still end up losing all the money that they've put into it.

5. Trade forex (the foreign exchange markets).

The forex market is the world's largest industry in terms of turnover. Over $6 trillion per day are traded on the forex markets. This is a very high risk industry for those who don't know what they are doing. There's a saying that the fastest way to make a small fortune trading forex, is to start with a large fortune. However, the banks and hedge funds regularly make very large profits through forex trading. They do it by employing traders with many years of experience, and package their know-how and expertise into computer programs known as algorithms or bots which work with lightning speed to analyse the market conditions, find profitable investment opportunities, make the trades, and close them more often than not on profits.

A manager in one of the world's major banks told me recently that their forex trading makes them an average profit of 40% per year. However he added that it's a very volatile business and the range of profits could be 80% higher or lower than that in any given year; in other words they might make as much as 120% profit, or they might lose 40% at the extremes. This volatility makes many people believe that it's not worth having anything to do with, which is to be expected, because most people have an automatic, very negative attitude to risk. We will come back to see if there is another way to work the forex market, and another way to think about risk.

Make Compound Growth work for you

So what are the principles that we need to understand if we're not going to be the average person who never gets wealthy? It boils down to 3 topics:

money, time and growth, and risk.

Money

You might think if you already have lots of money, then you are already wealthy, and don't need any more. But wealthy people tend to be those who make the most money, which is what keeps them wealthy and over time makes them even richer than the others. Most people who are interested in building their wealth start out with very little money, so we need to see how we can use time, growth and risk to get wealthy in a way that most people never will.

Time & Growth

Saving a little money, investing it well, and watching it grow at normal rates, will make you wealthy after a few decades.

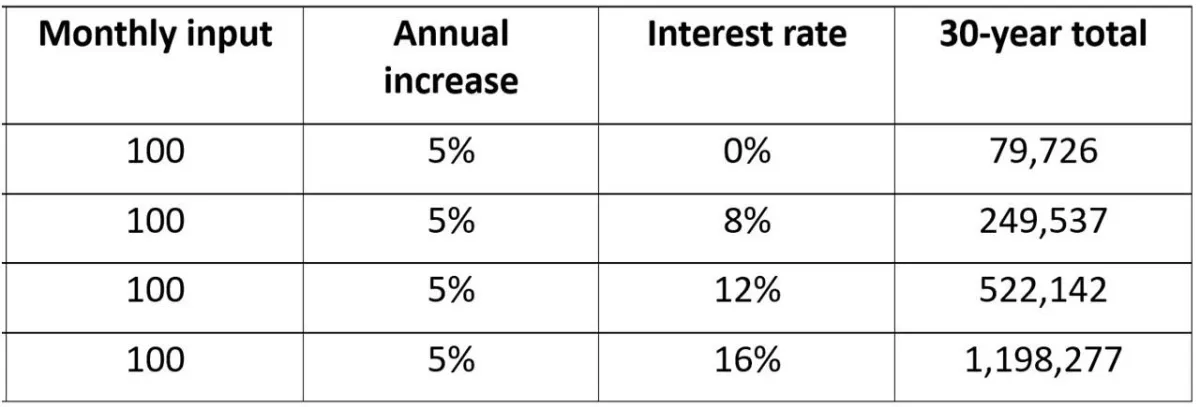

If you start without any money, and save £100 a month into an investment, and increase the amount you save every year by 5% to keep ahead of inflation, let’s look at where you would get.

What you can see here is that the interest rate makes a massive difference to the ending amount after 30 years. If you put the money under the mattress, and made no interest on it, you would have saved less than £80,000 over 30 years.

Tracking the stock market might give you 8% growth on average, and that means that the accumulated interest, including the interest earned in later years on the interest you made in the early years, takes the total almost to a quarter of a million.

If you could increase the interest rate, or growth rate from 8% to 12%, it would double the ending amount.

And if you could take it up from 12% to 16%, in a better investment, you would double the ending amount again, to almost £1.2 million.

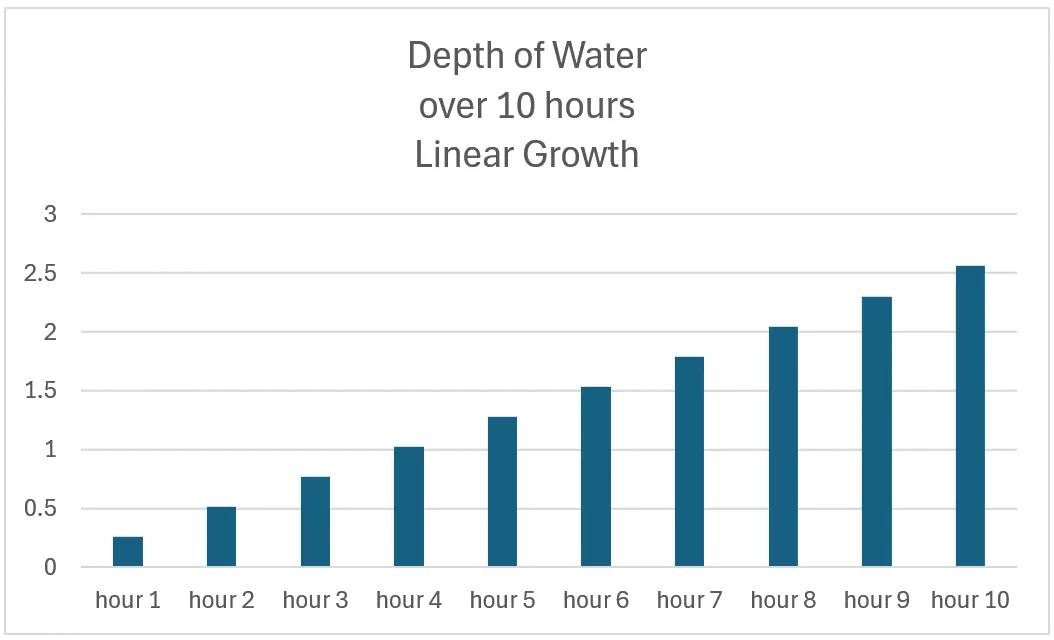

Normal "linear" Growth

Linear (or "Normal") growth

Most people think of growth as linear growth, the way a tree grows. If it grows 2 feet in a year, it will grow 20 feet in 10 years, and 40 feet in 20 years.

Think of a swimming pool 2.56m deep, which is going to fill up over 10 hours. If the rate of filling is linear, it will gain 25.6cm of water every hour, and at the end it will be full.

Linear growth is easy to understand. That is the kind of growth we picture in most cases. But compound growth means that the amount you grow is not a fixed amount more each year, but a percentage increase every year. And that works very differently, and is the secret to creating wealth.

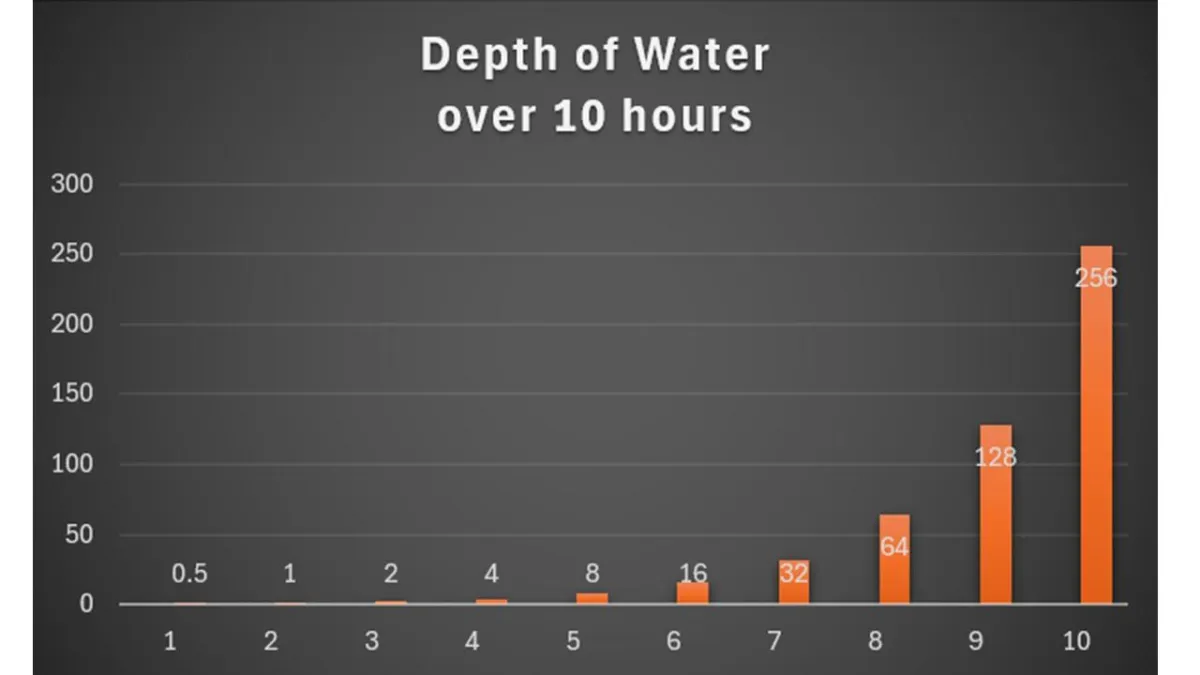

Compound Growth, Compound Interest, or Exponential Growth

Most people do not understand the power of Compound Growth, also known as Compound Interest or Exponential Growth. Albert Einstein is quoted as saying: "Compound Interest is the eighth wonder of the world. Those who understand it, earn it, and those who don’t, pay it."

If our swimming pool example was to fill up exponentially, with the amount of water in the pool doubling each hour, then it would start with just 0.25cm of water, which would double to 0.5cm, 1.0cm, 2cm, 4cm and 8cm in the first 6 hours.

That hardly seems like enough to make a difference, but in the last few hours it would reach 32cm, 64cm, 128cm, then 256cm in the tenth hour. The point here is that the pool would look empty for more than half the time, and the rate of filling would seem huge in the last 2 hours, as things speed up. In litres of water, that is so, as the amount added every hour starts really tiny, and gets more every hour. But the rate of increase is constant, doubling every hour, and that makes the whole thing spectacular in the last hour or two.

Now think how this applies to your savings. If you save linearly, you will never make much difference to your wealth, even over a long period of time. But if you can use compound interest, or exponential growth, to power up your savings, you can get seriously rich within a much shorter time. Compound interest works by making money in each period not just

from the money you put in to start with, but the interest you have earned on that money since then. Every month, or year, you are earning interest on a bigger amount, and while the rate of growth is constant, the amount of growth keeps getting bigger and bigger in money terms.

Higher growth rates, or Interest

So let’s look at what happens if you can earn more interest, or find a faster rate of growth. Let’s assume this time that your contributions stay flat at £100 per month, and you still start with no capital at all. In 30 years, you would have saved £36,000. If you could get interest at 16% per year, that would bring your 30-year total over £887,000 and if you could get 25% per year interest, it would grow to over £8 million.

You might think that these figures are pure fancy, but this is the way that successful internet marketing companies grow. They find a product with strong demand, and a supply of materials that is significantly cheaper, so the profit margin is often over 50% of the sale price. then they find ways of marketing the product that are efficient, and produce a 2:1, or even a 5:1 return on their marketing spend. And that opens the way to massive growth, if you are prepared to put all the profits back into marketing to grow the sales line as fast as possible.

Even better than that, some traders working in the forex market get monthly returns that are in the range of 10-50%. With many of these, there is a high level of risk, but not with all. We will talk about risk in a minute.

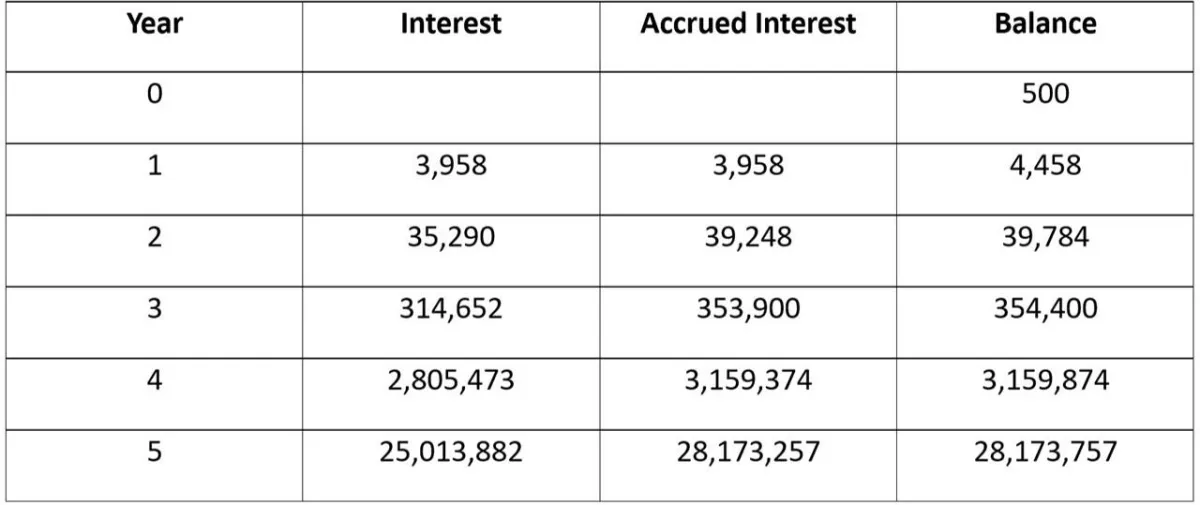

Just look at what a monthly interest rate of 20% can do to a small starting deposit of just £500. If you compound 20% monthly for a year, it comes out at over 790% a year, meaning that the interest earned each year is far greater than the balance at the start of that year. Here are the results of growing just £500, without making any further contributions, at 20% per month:

Even if you could not wait 5 years to build up wealth like this, and started taking all the income out after just 2 years, that would be over £6,500 a month, which is enough for many people to live on very comfortably. And if you waited for 3 years, and then took all the income, it would be a monthly “salary” of just over £59,000 which is more than just about anyone earns, other than a top footballer.

Risk & Opportunity

So what about the risk? Let’s talk that through. When most people think about risk, they think only about the downside risk, or “what could go wrong”. As a species, we are hard-wired to think harder about threats than opportunities, because back in the caveman days, a mistake over a threat meant immediate death, while a mistake over an opportunity might mean a little less food to share, but nothing too serious. So our brains are constructed to make us risk-averse, although this varies from person to person.

How does that affect our financial thinking, and the quality of our lives? For one thing, it means that many people don’t take advantage of opportunities that could change their lives, if those opportunities are tainted with a word that inspires fear, such as “risk”. Rather than balancing the opportunity upside and the risk downside, they are simply put off by the word “risk” and never look further.

Making your own decision

So if you were offered an investment opportunity with massive growth potential, and there was an associated risk of losing everything you put into it, how should you react? The key here is to make sure that you don’t invest into the “risky” venture anything more than you can actually afford to lose. If that is £500, fine, keep your investment to that. Now you have the promise of the money growing like crazy, and building up significant wealth over a few years. But even if the very worst happened, and the whole account was lost, in reality you have lost £500 that you put into it, plus a dream of being wealthy without effort, very soon.

What is the risk in forex investments?

The risk for most people venturing into forex is significant. It comes from the leverage, the expertise of the trader, and the risk reduction strategies they use. The first factor is leverage. When you trade the forex markets, it is common to use leverage of 1:100, 1:300, or even 1:500. What that means is that for every pound you put with a broker, and risk on a trade, you are multiplying both the upside and the downside potential by that ratio, such as 500:1. If you buy dollars with one pound, you are effectively buying £500 worth of dollars. If the exchange rate goes in your favour, for every $0.01 that the market moves, you gain $5.00. and if the market goes the other way, for every $0.01 that the market moves, you lose $5.00.

If you placed your entire capital on one trade, you would make the fastest gains and losses, and would risk losing the entire value of your account on one bad trade. This is the equivalent of going racing, and placing your entire betting bank on the first horse. If you win, you make money fast, but if you lose, you have lost everything you were prepared to put at risk. To avoid this, most traders recommend placing only 1-2% of the account at risk on a trade, or at the very most 5% of it. This means that if you lost your 5% stake on ten consecutive trades, you would still have half your money left. So leverage increases both upside and downside risk, but cautious trading (i.e. small trades, relative to the money you have) mitigates that risk.

The next factor is the expertise of the trader. Inexperienced traders tend to lose a lot of money, whether they do it on stocks or on forex. Experienced, successful traders win significantly more trades than they lose. They can analyse the market for situations where they are more likely to win; they select those opportunities. They make sensible decisions about when to get out of a trade, either because it has made enough profit, or because it is making losses that seem unlikely to be reversed in the near future. So by taking profits prudently, and cutting losses to small amounts, they make more profit than they lose, and consistently come out ahead.

You can open an account that automatically copies the trades of an experienced trader, risking small percentages of your money on each trade, taking profits regularly and limiting your losses. Then you will make money, fairly steadily, and reliably. You could still hit an occasional losing day or week, but on average you should do well. As trading depends on activity in the market, which is different every day, daily results will vary. The fact that there is a very slight possibility of losing the whole account should not put you off investing, any more than the fact that there is a slight possibility of being killed in a car crash should put you off ever travelling by car. You can also reduce your risk by putting some of your profits in a low-risk investment or bank account, while the other part of your money is “at risk” and growing fast.

Now for Your Decision!

So we have looked at the good and bad sides of different investment paths:

Lifetime habit of investing “safely”

Sure and steady, if you have the self-discipline. Takes decades to build wealth: get rich slow.

Start your own business

If hugely successful, could sell the business for a few million in a few years. (Yes, and you could win the lottery too, but it is not likely.)

Most likely scenario: it fails within 5 years (60% fail in 5 years in the UK), or plateaus with long hours, hard work, and little to show for it (85% of UK businesses are in this situation). If you take this route, I strongly suggest joining www.entrepreneurscircle.org for advice and support, which will give you a far above-average chance of success.

Buy stocks & shares

Safe way: buy tracker funds, match the stock market.

Risky way: buy individual shares interest hope of getting outsized gains (and risk outsize losses). Most professional stock market investors fail to “beat the average” and at best will track the stock market as a whole. Amateurs seldom do better than professionals.

Side hustle on the Internet

It is possible to get rich quick with the right product, right approach, and the right guidance. It is also possible to fail and spend several years and thousands to make no appreciable progress. Most internet businesses need significant inputs of time and money to get started, flexibility, and willingness to learn fast from mistakes. Few people have all of these, hence few succeed.

Forex trading

High risk approach: try to do it yourself. If you learn to trade forex (www.babypips.com) and are prepared to put in the hours, you might get very wealthy. It takes many weeks to master, and months to get a level of competence where results are predictable.

The low risk approach: Find a successful trader and copy their trades automatically, in exchange for a share of your profits going to the trader. Sign up, set up an account, put in a little money, and sit back and watch it grow. Fast. www.easywealth.uk

Have questions you would like to discuss?

Every Thursday evening at 7:00 pm London time, Brian Helweg-Larsen holds an open Zoom meeting to explain how Compound Growth can be used to build your wealth. He is available to answer any and all of your questions, and help you to build your wealth in any way he can, based on his years of experience in business, teaching financial principles in the world's largest companies.

Click the button below if you would like to join the session, then enter your details, and we will send you an invitation by email.

(c) 2024 the Easy Wealth Partnership